I’ve explored many budgeting planners, and the best ones blend durability, thoughtful layouts, and motivational features to keep you on track. From compact, no-bleed paper options to stylish covers and customizable stickers, these planners cater to different needs and preferences. Whether you’re tracking expenses, paying bills, or setting savings goals, there’s a perfect fit for you. Keep going to discover how these planners can help you master your finances and reach your goals.

Key Takeaways

- Highlighting planners with flexible, undated formats and comprehensive sections for budgeting, debt, and goal tracking.

- Emphasizing durable, high-quality materials like water-resistant covers and no-bleed paper for longevity.

- Showcasing customizable layouts, stickers, motivational quotes, and organizational features for personalized financial management.

- Focusing on portable sizes and user-friendly designs suitable for both beginners and experienced budgeters.

- Considering value-added features, price points, and user reviews to select the best planners for achieving financial goals.

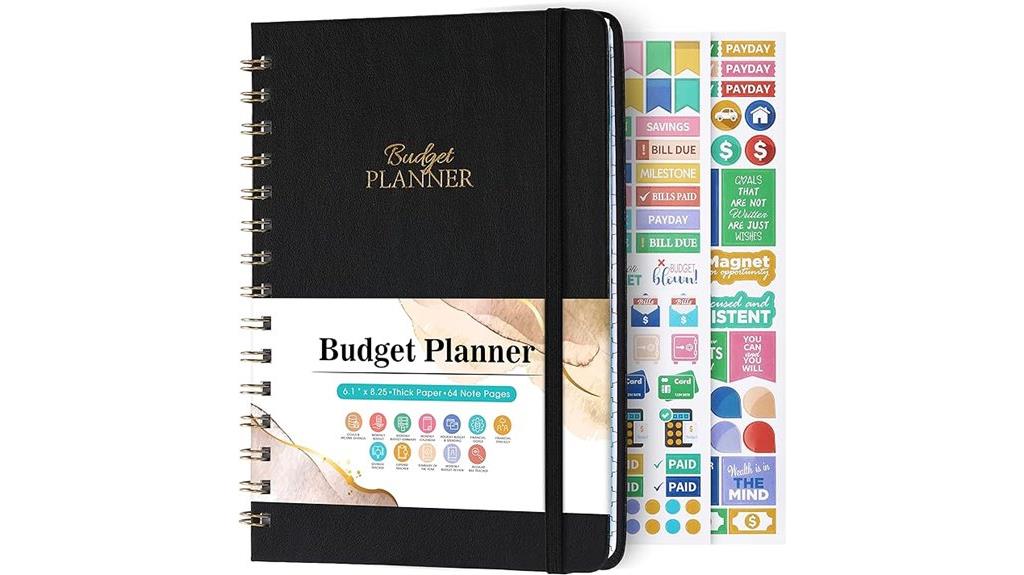

Budget Planner with Expense Tracker and Finance Organizer

If you’re looking for a straightforward way to manage your finances, the Budget Planner with Expense Tracker and Finance Organizer is an excellent choice. It offers an intuitive layout that makes tracking income, expenses, savings, and goals simple and organized. With dedicated pages for budgeting, debt tracking, and bill payments, you’ll stay on top of your financial details. The full-page calendars help you mark paydays and deadlines, while bonus stickers add a fun touch. Built with durability in mind, it features a water-resistant cover and handy pockets, plus a helpful guidebook to maximize your planning. This planner truly puts control of your finances within reach.

Best For: individuals seeking a comprehensive, user-friendly tool to organize and manage their personal finances effectively.

Pros:

- Intuitive layout makes tracking income, expenses, and savings straightforward

- Durable features like water-resistant cover and handy pockets enhance practicality and longevity

- Includes a helpful guidebook for maximizing budgeting efficiency

Cons:

- Undated format requires manual date entry each year, which may be time-consuming

- Limited customization options for personalized budgeting preferences

- May be too basic for advanced financial planning or investment tracking

Budget Planner with Bill Organizer and Expense Tracker

The Budget Planner with Bill Organizer and Expense Tracker is an ideal choice for anyone seeking an all-encompassing, flexible tool to manage their finances throughout the year. Its undated 12-month format allows you to start anytime, helping you track bills, expenses, savings, and debt effectively. The planner features sections for goal setting, monthly reviews, and financial strategies, encouraging disciplined money management. Its durable, high-quality paper and thoughtful design make it easy to organize and review your financial progress. With its portable size and comprehensive layout, it’s perfect for developing better spending habits and achieving your financial goals efficiently.

Best For: individuals seeking a comprehensive, flexible, and durable financial planner to manage bills, expenses, savings, and debts throughout the year.

Pros:

- Undated format allows starting at any time within the year for maximum flexibility

- High-quality, archival-grade paper that resists damage and reduces eye strain

- Portable size and robust design make it easy to carry and use consistently

Cons:

- Some users have experienced bending of the cover, which may require additional care or modifications

- Limited space for extensive financial details might not suit users with complex budgets

- The twin-wire binding, while functional, may not appeal to those preferring a more sleek or bound design

ZICOTO Monthly Budget Planner with Expense Tracker

The ZICOTO Monthly Budget Planner with Expense Tracker stands out as an ideal choice for individuals who want a simple, organized way to manage their finances over the long term. Its minimalist design keeps your focus on tracking income, savings, debts, and expenses without clutter. The undated format offers flexibility, letting you start anytime. Compact and portable, it fits easily in your bag for on-the-go use. With sections for goal setting, bill tracking, and monthly reviews, it encourages consistent habits. Plus, motivational quotes and stickers make budgeting engaging. Overall, this planner helps you build financial discipline while staying motivated and organized.

Best For: individuals seeking a minimalist, flexible, and portable budgeting tool to establish and maintain long-term financial discipline.

Pros:

- Easy-to-use undated format allows flexible start times and year-round planning

- Compact size (5.5×8.3 inches) makes it highly portable for on-the-go tracking

- Includes motivational quotes and stickers to enhance engagement and motivation

Cons:

- Limited to basic budgeting features; may lack advanced financial tracking options

- Paper quality, while durable, might not withstand heavy daily use for some users

- Does not include digital integration or app connectivity for tech-savvy users

SUNEE Budget Planner – Monthly Expense Tracker Notebook, Undated 12-Month Finance Organizer & Bill Record A5

Looking for a flexible budgeting tool that adapts to your schedule? The SUNEE Budget Planner is an undated, 12-month organizer designed to help you track income, expenses, savings, and bills effortlessly. Its vibrant layout features dedicated sections for goal setting, debt, and holiday budgets, with full-page calendars for detailed scheduling. The A5 size with a water-resistant cover, elastic band, and pocket makes it durable and portable. Users love its user-friendly design, ample space, and customizable stickers. With high ratings and practical features, it’s a great choice for anyone seeking a versatile planner that supports all-encompassing financial management.

Best For: individuals seeking a flexible, colorful, and comprehensive budgeting planner that adapts to their schedule and helps manage all aspects of personal finances.

Pros:

- Undated format allows for flexible starting points and year-round use

- Vibrant, user-friendly layout with dedicated sections for goals, debt, savings, and bills

- Durable features like water-resistant cover, elastic band, and portable size for on-the-go use

Cons:

- Limited cover design options and potential desire for more holiday section inclusivity

- Some users may find the number of sections overwhelming initially

- Price may be higher compared to simple budget notebooks without additional features

Budget Planner, Monthly Finance Organizer and Expense Tracker Notebook

If you’re seeking a practical tool to stay on top of your finances, this Budget Planner, Monthly Finance Organizer, and Expense Tracker Notebook stands out as an excellent choice. It features an undated design, allowing flexible start times, and covers a full year with sections for financial goals, savings, debts, and expenses. Its compact A5 size, high-quality 100gsm paper, and durable covers make it portable and easy to write in. Color-coded months and structured pages help track progress, set budgets, and review performance effortlessly. Customers love its thoughtful layout, quality materials, and usability, making it ideal for personal or household financial management.

Best For: individuals and households seeking an effective, portable, and customizable tool to manage their finances, track expenses, and achieve financial goals throughout the year.

Pros:

- Undated format allows flexible start times and year-round use.

- High-quality 100gsm paper and durable construction ensure longevity and ease of writing.

- Color-coded monthly sections and structured pages facilitate easy tracking, budgeting, and reviewing financial progress.

Cons:

- Limited to one-year usage; not reusable for multiple years without duplication.

- May require initial setup and familiarization due to its detailed layout.

- Slightly higher price point compared to basic budget notebooks, which may be a consideration for budget-conscious users.

Budget Planner, 7×10 Monthly Expense Tracker Notebook with Pockets and Tabs

Designed with both practicality and style in mind, the Budget Planner, 7×10 inch monthly expense tracker is perfect for anyone who wants to stay organized while managing their finances on the go. Its high-quality leather cover and elegant pink design make it attractive and durable. Inside, you’ll find spacious pages for tracking income, expenses, savings, and financial goals across 12 months. Pockets and tabs help keep bills, receipts, and notes handy, while stickers add extra organization. Whether you’re a beginner or experienced, this planner simplifies budgeting, helps set goals, and keeps your finances in check—all in a portable, stylish package.

Best For: individuals seeking a stylish, durable, and comprehensive budget planner to manage personal finances, savings, and expenses on the go.

Pros:

- High-quality leather cover and elegant pink design for durability and style

- Comes with pockets, tabs, and stickers for enhanced organization

- Suitable for both beginners and experienced users with comprehensive financial planning features

Cons:

- The 7×10 size may be less portable for those preferring smaller planners

- Limited to 12 months, requiring replacement or transfer for long-term use

- Price may be higher compared to simpler expense trackers without additional features

Budget Planner and Bill Organizer

The Budget Planner and Bill Organizer is an ideal choice for anyone seeking a flexible, all-in-one tool to manage their finances throughout the year. Its undated, portable design lets you start anytime, with dedicated pages for tracking income, expenses, savings, and debts. The planner includes monthly budgeting sheets, bill management sections, and detailed debt payoff tracking. Made with durable materials, it features stickers for visual cues and a pocket for receipts. The layout promotes daily, weekly, and monthly routines, making financial oversight simple and engaging. Whether you’re a beginner or experienced, this organizer helps you stay accountable and on top of your money goals.

Best For: individuals seeking a versatile, portable, and easy-to-use financial planner to manage their bills, expenses, and savings throughout the year.

Pros:

- Undated format allows flexible start anytime during the year.

- Durable materials and compact size make it portable and long-lasting.

- Includes stickers and visual cues that enhance engagement and tracking motivation.

Cons:

- Not refillable, limiting long-term use beyond initial purchase.

- Limited space for daily detailed tracking, which may not suit advanced budgeting needs.

- Some users may find the fixed layout less customizable for specific financial scenarios.

Monthly Budget Planner Book (Undated) with 12 Pockets

Looking for a flexible budgeting tool that adapts to your unique financial situation? The Monthly Budget Planner Book (Undated) with 12 Pockets is perfect for customizing your money management. Its blank, pre-filled pages let you track income, expenses, savings, and debt without restrictions, whether daily, monthly, or yearly. The 12 pockets make organizing bills, receipts, and envelopes a breeze, while the spiral binding keeps it durable and portable. With clear visuals and bonus sticker labels, it’s easy to navigate and stay motivated. This planner helps you stay organized, monitor progress, and celebrate your financial wins throughout the year.

Best For: individuals and small households seeking a customizable, portable, and organized budgeting tool to manage income, expenses, savings, and debt throughout the year.

Pros:

- Fully customizable with blank and pre-filled pages to suit personalized financial tracking needs

- Includes 12 pockets for effortless organization of bills, receipts, and envelopes

- Durable spiral binding and compact size make it portable and built to last

Cons:

- Undated format requires users to manually update or create their own date system

- Might be limited for users seeking digital or automated budgeting solutions

- No included digital features or integrations for online financial management

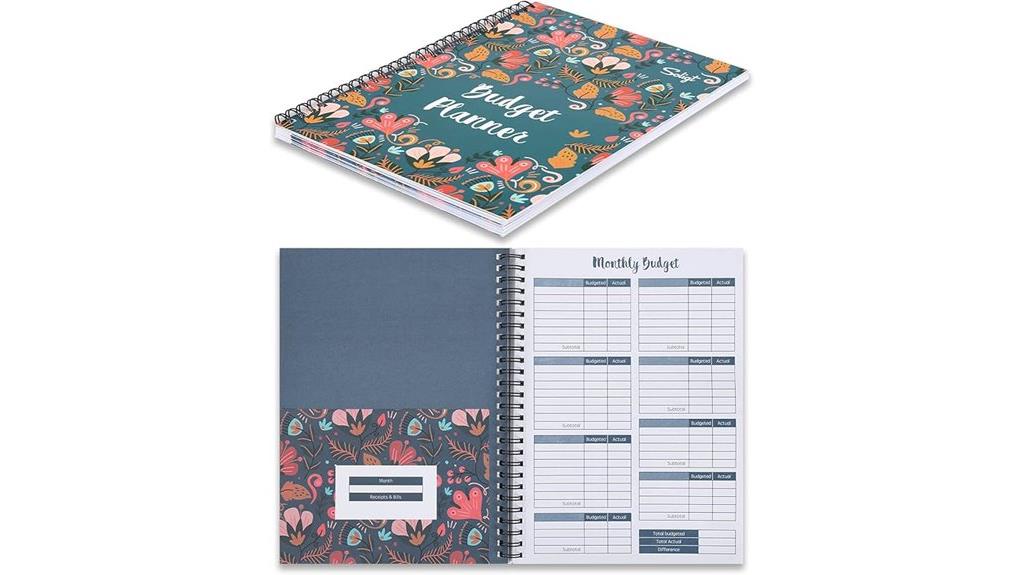

Budget Planners – Monthly Finance Organizer

If you want a flexible and all-encompassing way to organize your finances, the Budget Planners – Monthly Finance Organizer is an excellent choice, especially for those who prefer a color-coded system to quickly identify each month. This undated planner spans 12 months, with each month marked by a distinct color, making navigation easy. It features dedicated sections for setting financial goals, tracking expenses, managing savings and debts, and reviewing progress. Additional pages focus on Christmas budgeting and annual summaries, helping you stay on top of your financial year. Its sturdy design, clear layout, and helpful reminders make it a practical tool for anyone seeking comprehensive financial control.

Best For: individuals seeking a flexible, color-coded, and comprehensive tool to organize and improve their personal finances throughout the year.

Pros:

- Color-coded monthly sections for quick and easy identification

- Includes extensive features such as goal setting, expense tracking, and annual reviews

- Durable design with high-quality materials and practical extras like inner pockets and note pages

Cons:

- Undated format requires users to customize start dates each year

- May be too comprehensive for those seeking only basic budgeting tools

- Limited to one-year planning, which may not suit long-term financial planning needs

HAUTOCO Hardcover Bill Tracker Notebook for Personal Budgeting

Are you tired of losing track of your bills and expenses? The HAUTOCO Hardcover Bill Tracker Notebook is a game-changer. Its horizontal monthly organizer is perfect for personal budgeting, with plenty of space for detailed entries on payment status, due dates, and amounts. The durable PU leather cover and spiral binding let you lay it flat for easy use. With large pockets for receipts and bills, plus calendar and goal pages, it keeps everything in one place. Whether for personal or small business use, this notebook helps you stay organized, monitor expenses, and maintain clear financial records effortlessly.

Best For: individuals and small business owners seeking a comprehensive, durable, and organized way to track bills, expenses, and financial goals effortlessly.

Pros:

- Durable PU leather hardcover with lay-flat spiral binding for easy writing and durability

- Large pockets and space for receipts, bills, and detailed transaction entries

- Includes calendar, goal pages, and note sections for comprehensive financial planning

Cons:

- Size may be too large for portable use or small bags

- Limited to 120 pages, which may require frequent refilling for heavy users

- Not designed with digital integration, so manual entry is necessary

Soligt Budget Planner 2025 with 12 Pockets

The Soligt Budget Planner 2025 with 12 Pockets is ideal for anyone seeking a flexible and organized way to manage their finances throughout the year. Its undated, spiral-bound design makes it easy to carry and customize, with blank and pre-filled pages for monthly, weekly, and annual budgeting. The 12 colorful pockets provide convenient storage for bills, receipts, and envelopes. With features like a bill calendar, paying reminders, and bonus month tabs, this planner helps me stay on top of expenses, savings, and debt. It’s a practical tool that simplifies financial management, making it easier to set goals and track progress effortlessly.

Best For: individuals and small households seeking a customizable, portable, and comprehensive financial planning tool to manage budgets, expenses, and savings throughout the year.

Pros:

- Undated design allows for flexible start dates and customization

- Includes 12 colorful pockets for organized storage of bills and receipts

- Features like a bill calendar and paying reminders help maintain financial discipline

Cons:

- Spiral binding may wear out with extensive use over time

- Limited to 100 gsm paper, which might not be ideal for heavy note-taking or marker use

- May require additional digital tools for advanced financial tracking or analysis

Budget Planner – Monthly Bill Organizer with Pockets

The Budget Planner – Monthly Bill Organizer with Pockets is ideal for anyone looking to streamline personal finances and keep important documents in one place. I find it perfect for tracking expenses, managing bills, and setting financial goals without clutter. Its undated design allows flexibility, while the 12-month structure helps me review progress and adjust strategies. The planner’s durable vegan leather cover, elastic band, and back pocket keep receipts and bills organized. With thick no-bleed paper and handy accessories like index stickers, it’s both functional and stylish. Overall, this organizer makes managing my finances straightforward and helps me stay on top of my financial goals.

Best For: individuals seeking a flexible, durable, and comprehensive tool to organize their personal finances, track expenses, and set financial goals effortlessly.

Pros:

- Undated design offers flexibility to start anytime and customize according to needs

- Includes practical accessories like index stickers and currency navigation stickers for enhanced organization

- Durable vegan leather cover with thick no-bleed paper ensures longevity and a premium feel

Cons:

- Size (7 x 10 inches) may be too large for those preferring compact planners

- No built-in digital features or integrations for tech-savvy users

- May require regular manual input, which might be time-consuming for some users

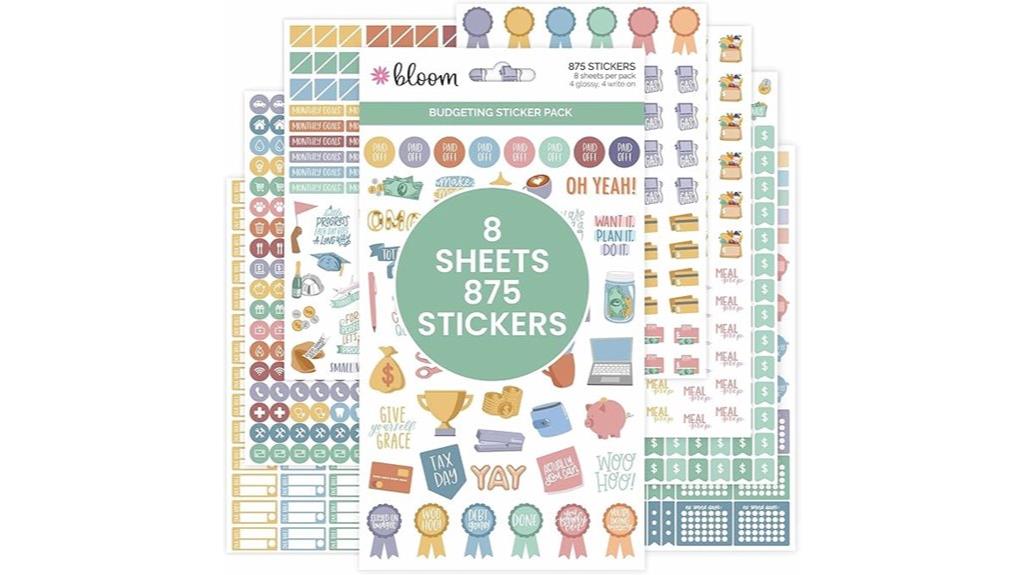

Budget Planner Stickers for Personal Finance Tracking

If you’re looking to make personal finance tracking more enjoyable and visually appealing, Bloom Daily Planners’ Budget Planner Stickers are an excellent choice. These 8 sheets feature 875 hand-drawn icons and phrases, including useful symbols for utilities, groceries, paydays, and travel, plus motivational phrases like “Monthly Goals” and “Progress Check.” The stickers come in glossy and matte finishes, allowing you to write directly on them or personalize with your own notes. They’re perfect for decorating planners or calendars, making budget tracking engaging and fun. With high ratings and positive reviews, these stickers help keep your financial goals organized and visually inspiring.

Best For: individuals who want to add a fun, decorative, and functional touch to their personal finance planning and budgeting routines.

Pros:

- Hand-drawn, adorable icons and phrases enhance visual appeal and motivation

- Suitable for writing directly on glossy or matte sheets for customized notes

- High customer ratings (4.7/5) indicate quality and user satisfaction

Cons:

- Stickers are small, which may make writing full amounts difficult

- Designed for single-use, limiting long-term reusability

- Primarily intended for indoor planner decoration, not for outdoor or heavy handling

Factors to Consider When Choosing a Finance Budgeting Planner

When selecting a finance budgeting planner, I focus on how well it matches my budgeting style and daily routine. Size, portability, and customization options also matter to make sure it fits my needs and preferences. Finally, I consider its durability, layout, and organization to keep my finances tidy and accessible.

Budgeting Style Compatibility

Choosing a budgeting planner that matches your preferred style can substantially boost your financial organization. It’s essential to select a layout aligned with your method, whether that’s zero-based budgeting, the envelope system, or simple expense tracking. Decide if you want an undated planner for flexibility or a dated one for structure around specific periods. Consider the organizational style—do you prefer color-coded sections, visual trackers, or a minimalist design? Make sure it supports your financial goals, like debt reduction or savings, through dedicated or customizable pages. Also, think about your routine—whether you log expenses daily, review weekly, or summarize monthly. Picking a planner that suits your style ensures consistency, makes budgeting easier, and keeps you motivated to reach your financial goals.

Size and Portability

Selecting the right size for your budgeting planner can make a significant difference in how comfortably and efficiently you manage your finances. If you’re always on the go, a compact size like A5 or smaller is ideal, as it’s easy to carry in your pocket or small bag. Larger planners, such as 7×10 inches, provide more space for detailed notes but can be bulky and less portable. Lightweight materials and slim designs enhance portability, making it simple to transport without extra bulk. Spiral-bound or lay-flat formats also make writing easier in tight spaces, especially when traveling. Ultimately, your choice should match your routine—whether you prefer a pocket-sized planner for quick access or a larger one for extensive tracking at home or work.

Customization Options

Opting for a budgeting planner that offers customization options guarantees it fits your unique financial needs and preferences. Look for planners with undated formats so you can start anytime and use them year-round without restrictions. Check if they have customizable sections like goal setting, expense categories, and financial strategies, allowing you to tailor the planner to your specific situation. Features like removable or adjustable tabs, stickers, or color-coding make organizing and visualizing your progress easier and more personalized. Consider planners that let you add or remove pages or sections as your financial goals change, providing flexibility over time. Additionally, opt for options that are printable or refillable, so you can update and adapt your planner without buying a new one each year.

Durability and Materials

When evaluating the durability of a finance budgeting planner, I focus on the materials used in its construction. I look for planners made with high-quality, thick paper—preferably 100gsm or higher—to prevent ink bleed and guarantee they hold up with daily use. A sturdy cover, like hardcover or reinforced soft covers, is essential to withstand wear and tear over time. Water-resistant materials or protective coatings help guard against spills and moisture damage. I also prioritize planners with durable binding methods, such as spiral or twin-wire binding, which lay flat and resist breaking. Additional features like elastic bands, pockets, or bookmarks should be made from strong, long-lasting materials to boost the planner’s overall longevity and assure it remains reliable throughout the year.

Layout and Organization

A well-organized finance budgeting planner should have clear sections for income, expenses, savings, and financial goals, making it easier to track and manage your finances. Monthly layouts with dedicated pages for bills, debts, and cash flow provide a thorough overview, helping you stay on top of your financial picture. Visual elements like color-coding, charts, or icons can make navigation quick and intuitive, saving you time. Ample space for detailed entries, notes, and reflections supports thorough analysis and planning, ensuring you can record insights and adjustments easily. Additionally, features like tabs, dividers, or indexed sections help you access different areas swiftly, reducing confusion. The right layout promotes efficiency and clarity, making your budgeting process smoother and more effective.

Additional Features

Choosing the right finance budgeting planner involves considering extra features that can make tracking easier and more enjoyable. Features like sticker sheets, color-coding, and motivational quotes can boost engagement and make managing finances less tedious. Additional components such as pockets, tabs, or binders help keep receipts, notes, and important documents organized and accessible. Built-in calendar pages, goal-setting sections, and review prompts support ongoing reflection and discipline, helping you stay on track. Durable features like water-resistant covers, elastic closures, and sturdy bindings increase the planner’s lifespan and portability for daily use. Incorporating digital elements, such as QR codes or companion apps, can provide supplemental support and seamless updates. These extras enhance usability and motivate consistent financial habits.

Price and Value

Ever wondered how to get the most value out of your investment in a budgeting planner? Comparing prices helps make sure you choose a product that matches your needs without overspending. Higher-priced planners often feature premium materials, extra sections, or customization options that justify their cost. It’s important to select a planner that fits your financial situation so you don’t waste money on unnecessary features. Checking customer reviews and ratings can reveal if a planner’s perceived value aligns with its price. Also, look for special offers, discounts, or bundled deals—these can boost the overall value by offering more features at a lower cost. Balancing price with quality and features ensures you get a planner that genuinely supports your financial goals without breaking the bank.

User-Friendliness

When selecting a finance budgeting planner, prioritizing user-friendliness guarantees you can manage your finances with ease and confidence. An intuitive layout helps you navigate and understand the planner quickly, even if you’re new to budgeting. Clear labels, simple instructions, and visual cues like color-coding make it easy to find and use different sections without frustration. Large, legible fonts and plenty of space for entries prevent clutter and make daily updates comfortable. Including helpful guides or tips can simplify complex processes and reduce the learning curve. Accessibility features like undated formats, portable size, and minimal complexity guarantee you can start and maintain your budget effortlessly. Ultimately, a user-friendly planner keeps you engaged and motivated on your financial journey.

Frequently Asked Questions

How Do I Select a Planner Suited to My Financial Goals?

When choosing a planner suited to my financial goals, I start by clarifying what I want to achieve—saving for a house, paying off debt, or investing. Then, I look for features that match those goals, like tracking expenses or setting savings targets. I also consider ease of use and compatibility with my lifestyle. This way, I find a planner that keeps me motivated and on track to reach my financial dreams.

Are Digital or Paper Planners More Effective for Budgeting?

When choosing between digital and paper planners for budgeting, I find it really depends on your personal style. Digital planners are great if you want easy access, automatic updates, and reminders. Paper planners feel more tangible and can be more satisfying to write in, helping me stay engaged. I recommend trying both to see which one suits your routine best—whichever helps you stay consistent and motivated works best.

Can These Planners Accommodate Irregular Income Sources?

When it comes to irregular income, I find that many budgeting planners can be flexible enough to help. I look for ones that let me customize income entries and include buffer categories for fluctuations. Digital planners often make it easier to adjust amounts quickly, while paper ones can be more visual for tracking changes over time. Ultimately, choosing a planner that adapts to your income pattern is key to staying on top of your finances.

How Often Should I Review and Update My Budget Planner?

I believe reviewing and updating my budget planner should happen regularly to stay on track. I personally check mine weekly or bi-weekly, especially if I have irregular income or expenses. This way, I can adjust for any changes and make sure I’m meeting my financial goals. Staying consistent helps me catch issues early and keeps my finances organized. I recommend finding a rhythm that works best for your income and lifestyle.

Do Budget Planners Help Improve Long-Term Financial Habits?

Absolutely, budget planners can considerably improve your long-term financial habits. I’ve found that they keep me accountable, help me track my expenses, and set clear goals. Regularly updating my planner makes me more mindful of my spending and savings patterns. Over time, this consistency fosters discipline and better decision-making, which ultimately leads to healthier finances. So yes, using a budget planner can truly transform your financial habits for the better.

Conclusion

Choosing the right finance budgeting planner is like planting a seed—nurture it consistently, and watch your financial garden grow. With the perfect tool in hand, you can turn chaos into clarity and dreams into realities. Remember, the key isn’t just in the planner itself, but in your commitment to use it daily. So, pick what fits you best, and let your financial journey flourish—because your future self will thank you.